Metamorphose Global Supply Chain To Address Disruption Risks

Mahesh Khetan is currently working as Global Head, Special Projects with five Businesses in Aditya Birla Group - in Chemicals, Insulators & Fashion Yarn Sector. Prior to the current assignment, he was heading global supply chain of Specialty Chemicals Business of Aditya Birla Group. In the past, he has handled various profiles like heading manufacturing of soy food product swith Sterling Infotech Group, heading food processing factories at Aditya Birla Retail Ltd and Business Excellence & Supply Chain at Aditya Birla Fashion Ltd.

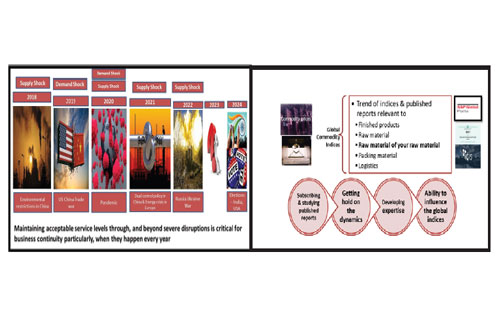

Major disruptions of global scale have become a way of life. Every year, some kind of global disruption has been taking place resulting in either a supply shock or a demand shock; thereby impacting the supply chain. If we evaluate last five years, for example, in the year 2018, many factories in China had shut down due to environmental restrictions imposed by the country, resulting in supply shock. In 2019, there was US China trade war creating a demand shock. Then came the pandemic in 2020 creating supply shock in first half of the year and then the demand shock towards the end of the year. 2021 has seen dual control policy imposed by China, again resulting in shutting of factories over there, creating supply shock. This was also accompanied by energy crisis in Europe, further intensifying the supply shock. Year 2022 has seen Russia Ukraine war, resulting in supply shock from Europe. Now, we are in the year 2023 which may see some major disruption we do not know about. Year 2024 is the year of disruption by design, being a year of two major elections in the world – Lok Sabha election in India and Presidential election in USA.

When major disruptions happen every year, it becomes critical to metamorphose our supply chain to ensure business continuity. Building supply chain resilience and continuously strengthening it is no more a mere ‘Good to Have’, but it is now a ‘Must to Have’!

Some of the ways to transform the supply chain include:

Metamorphose the Planning Process– Creating right blend of data and market intelligence Identification of lead indicators which, impact your business or industry is critical to address disruption risks in the planning process. This requires strengthening sources of competitive intelligence and many more variables going as input to the planning exercise, than the conventional ones.

Few ways to reinforce sources of competitive intelligence:

•Global commodity indices– Normally, indices directly related to the raw material and finished goods are referred and analysed as an input to the planning exercise. In addition to this, if indices of raw material of raw material and further backward are analysed along with other indirectly relevant indices like that of logistics, packing material, related customers’ customer’s industries; it can strengthen the planning process by providing early trend indicators. Enhancing maturity level of analytics related to indices results in an organizational ability to predict and even influence these indices

•Demand Supply Gap– Many times, it is observed the actual price prevailing in the market do not follow the published indices, but they follow the demand supply gap related to a particular product/commodity. Deep understanding of this helps tremendously in planning & forecasting. Tracking new capacity additions of your FG, RM, RM of RM, FG of FG; planned & unplanned shutdowns of factories; mergers & acquisitions; joint ventures; backward & forward integration of vendors & competitors strengthens competitive intelligence

•Import Export Data–Proper analysis of this can do miracles in the planning process. EXIM data analysis of not just the country where you are located, but also that of the countries where your vendors & global competitors are located and of the countries where maximum trade of your products takes place, provides useful insights regarding new contracts and change in trade flow which, leads to regional price fluctuation

Network Optimization

Network of storage locations requires continuous modification to suit the changing complexities of the market. Restructuring the network wherever needed and partnering with loyal suppliers while doing so help in navigating the complexities. Firstly, we need to understand what leads to network complexities. Global disruptions happening every year enhance network complexities. Analysing the network more frequently than it used to be done in the past, restructuring the network wherever needed and partnering with loyal suppliers while doing so not only helps in navigating the complexities of networks but also takes business relationships to a different level.

Using third-party service providers in logistics and warehousing, structuring delivery terms in purchase orders in a manner that vendors deliver to the factory or to a nearby port (CIF, DAP, DDP kind of incoterms), and using technology such as track-and-trace tools are options that most organisations are using nowadays irrespective of whether they are big or small. These come with distinct benefits to the organisation and it is mostly not the core area where an organisation needs to focus on by deploying its own employees. Instead, shifting focus on essential activities and maximising profits and creating competitive advantage by outsourcing some of the logistics/tracking/ monitoring activities can empower key resources significantly.

Inventory & Working Capital Management

The way, short and long-term contracts are managed determines the inventory, working capital through payment terms, availability of material at factories and warehouses, which in turn, impacts manufacturing efficiency. Digitising inventory management using Integrated Business Planning, dynamic safety stock management, getting enhanced visibility of all shipments, analysing lead indicators are some of the things which may equip an organisation to avoid undesirable situations, in a better manner

Different ways to manage credit period and working capital need to be thought through. Bill discounting from countries having very low interest rates (e.g. less than one percent per year) can be seriously explored and become a part of the long term vendor-customer contracts.

Major disruptions of global scale have become a way of life. Every year, some kind of global disruption has been taking place resulting in either a supply shock or a demand shock; thereby impacting the supply chain. If we evaluate last five years, for example, in the year 2018, many factories in China had shut down due to environmental restrictions imposed by the country, resulting in supply shock. In 2019, there was US China trade war creating a demand shock. Then came the pandemic in 2020 creating supply shock in first half of the year and then the demand shock towards the end of the year. 2021 has seen dual control policy imposed by China, again resulting in shutting of factories over there, creating supply shock. This was also accompanied by energy crisis in Europe, further intensifying the supply shock. Year 2022 has seen Russia Ukraine war, resulting in supply shock from Europe. Now, we are in the year 2023 which may see some major disruption we do not know about. Year 2024 is the year of disruption by design, being a year of two major elections in the world – Lok Sabha election in India and Presidential election in USA.

When major disruptions happen every year, it becomes critical to metamorphose our supply chain to ensure business continuity. Building supply chain resilience and continuously strengthening it is no more a mere ‘Good to Have’, but it is now a ‘Must to Have’!

Some of the ways to transform the supply chain include:

Metamorphose the Planning Process– Creating right blend of data and market intelligence Identification of lead indicators which, impact your business or industry is critical to address disruption risks in the planning process. This requires strengthening sources of competitive intelligence and many more variables going as input to the planning exercise, than the conventional ones.

Few ways to reinforce sources of competitive intelligence:

•Global commodity indices– Normally, indices directly related to the raw material and finished goods are referred and analysed as an input to the planning exercise. In addition to this, if indices of raw material of raw material and further backward are analysed along with other indirectly relevant indices like that of logistics, packing material, related customers’ customer’s industries; it can strengthen the planning process by providing early trend indicators. Enhancing maturity level of analytics related to indices results in an organizational ability to predict and even influence these indices

•Demand Supply Gap– Many times, it is observed the actual price prevailing in the market do not follow the published indices, but they follow the demand supply gap related to a particular product/commodity. Deep understanding of this helps tremendously in planning & forecasting. Tracking new capacity additions of your FG, RM, RM of RM, FG of FG; planned & unplanned shutdowns of factories; mergers & acquisitions; joint ventures; backward & forward integration of vendors & competitors strengthens competitive intelligence

•Import Export Data–Proper analysis of this can do miracles in the planning process. EXIM data analysis of not just the country where you are located, but also that of the countries where your vendors & global competitors are located and of the countries where maximum trade of your products takes place, provides useful insights regarding new contracts and change in trade flow which, leads to regional price fluctuation

Network Optimization

Network of storage locations requires continuous modification to suit the changing complexities of the market. Restructuring the network wherever needed and partnering with loyal suppliers while doing so help in navigating the complexities. Firstly, we need to understand what leads to network complexities. Global disruptions happening every year enhance network complexities. Analysing the network more frequently than it used to be done in the past, restructuring the network wherever needed and partnering with loyal suppliers while doing so not only helps in navigating the complexities of networks but also takes business relationships to a different level.

Using third-party service providers in logistics and warehousing, structuring delivery terms in purchase orders in a manner that vendors deliver to the factory or to a nearby port (CIF, DAP, DDP kind of incoterms), and using technology such as track-and-trace tools are options that most organisations are using nowadays irrespective of whether they are big or small. These come with distinct benefits to the organisation and it is mostly not the core area where an organisation needs to focus on by deploying its own employees. Instead, shifting focus on essential activities and maximising profits and creating competitive advantage by outsourcing some of the logistics/tracking/ monitoring activities can empower key resources significantly.

Inventory & Working Capital Management

The way, short and long-term contracts are managed determines the inventory, working capital through payment terms, availability of material at factories and warehouses, which in turn, impacts manufacturing efficiency. Digitising inventory management using Integrated Business Planning, dynamic safety stock management, getting enhanced visibility of all shipments, analysing lead indicators are some of the things which may equip an organisation to avoid undesirable situations, in a better manner

Different ways to manage credit period and working capital need to be thought through. Bill discounting from countries having very low interest rates (e.g. less than one percent per year) can be seriously explored and become a part of the long term vendor-customer contracts.